Dealwise - Where Startups get Acquired

I recently got a chance to sit down and talk with Jason Fan, Co-founder of Dealwise, a YC W 23 startup, making the M&A space easier for both startup founders and acquirers.

I have been following this space for a while and have seen a lot of compelling activities, including the rise of platforms aiming to make M&A easier, roll-ups and search funds to acquire SaaS companies, and the emergence of a set of founders wanting to exit at an earlier ARR stage rather than the typical million-dollar venture exit or IPOs.

Base story

Dealwise is a marketplace connecting founders looking for an exit with equity-backed buyers looking to acquire SaaS companies founded by Jason and Ayan, two Ex-Robinhood tech folks. Recently, Dealwise graduated from Ycombinator's winter 2023 batch.

For founders - Dealwise offers a platform where they can list their companies and get access to vetted buyers, making the tedious M&A process easier for them.

For buyers - Dealwise offers one of the largest repositories of verified SaaS businesses, with more than one million ARR in revenue. Here, the process of getting quality deal flows becomes much easier, and acquirers can focus on due diligence and growth instead of cold-mailing founders for the deals.

The Origin

Dealwise was founded by Jason and Ayan, two seasoned tech folks who met while working at Robinhood, one of the US's most-watched fintech startups. While at Robinhood, Jason worked as a senior PM, and Ayan was on the engineering side. Both of them worked on the account security team, which dealt with user authentication, security, and more, where both founders gained their experience and expertise in building and scaling Fintech products.

Before Robinhood, both founders worked independently on several ventures and in various tech and engineering roles. Notably, Ayan had a startup with YC before and attended one of its earlier cohorts.

The team got into YC with a different fintech idea, focusing on tools and solutions to verifying accredited investors for various established fintech platforms (think angel funds, SVP platforms, equity-based fundraising platforms, etc.). Soon, the founding team realized that the market was smaller than they had expected in their original thesis, and this proved to be a huddle. Interestingly, the team did a few additional pivots while going through the same YC 23 winter batch before landing on the core idea of Dealwise.

The team looked at founder-market fit deeply while exploring current challenges and opportunities in the market. While talking to founders in their network, the team realized they knew many founders who raised their first seed rounds. But, these founders are struggling to raise more capital, and this puts founders in a unique position with no prospect for a traditional exit.

At the same time, the duo noticed that the valuation in the market for internet businesses is coming down from the zero-interest era, and there is a growing and healthy demand among buyers and acquirers for these companies. This led them to their original thesis behind Dealwise. The team started with launching the current platform (link) and got serious interest and strong signals from the community. Within weeks, the team facilitated multiple intros and conversions between buyers and sellers, which supported their initial thesis.

The market landscape

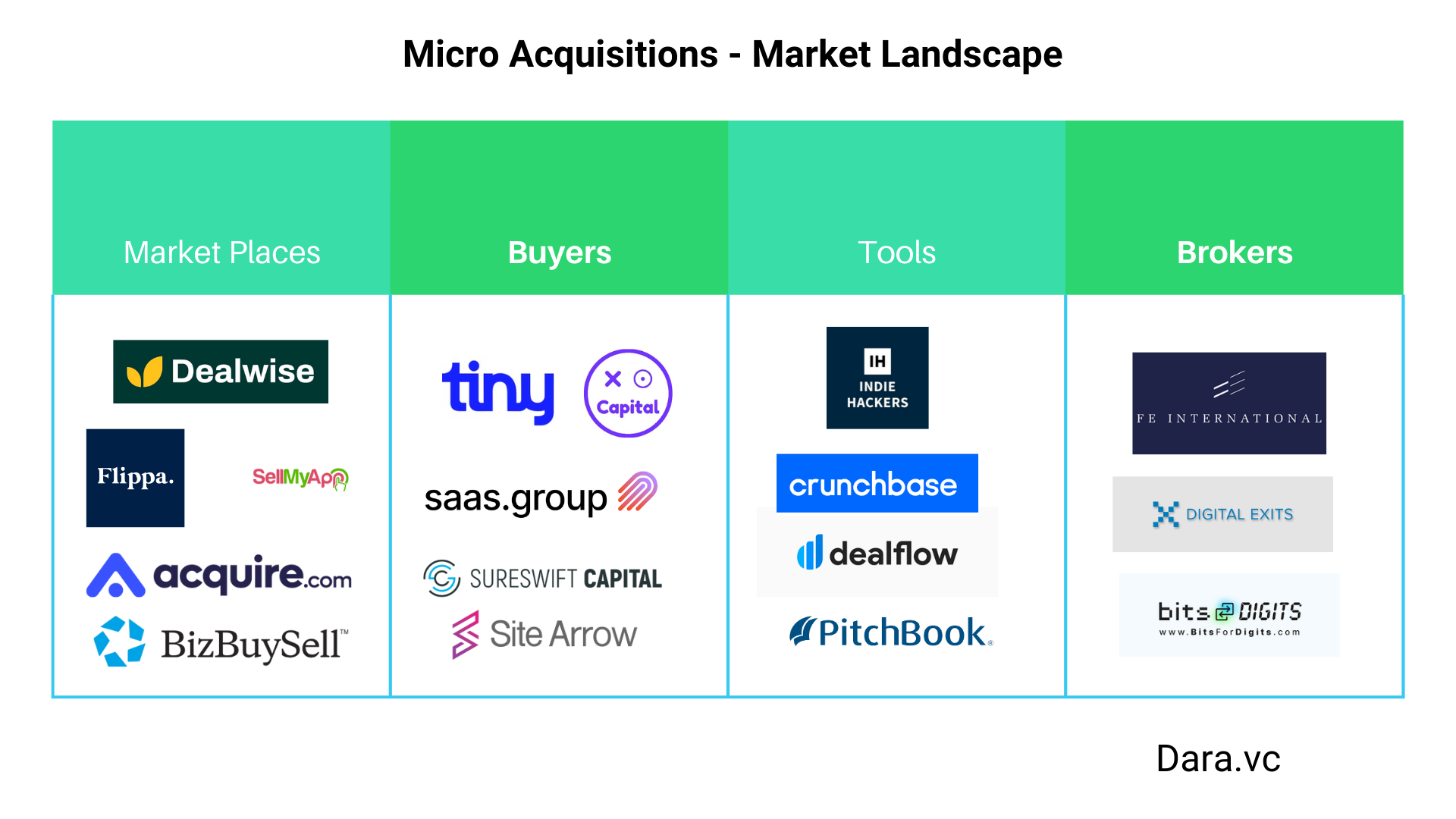

There has been a lot of activity in recent years in these spaces. There are several terms coined around this, starting with Micro-acquisition and more. In simple terms, this market revolves around acquiring profitable Internet businesses.

Traditionally, in a venture lifecycle, acquisitions come at later stages of growth. Typical VC-backed companies raise multiple rounds of capital, grow their businesses, acquire new clients, and increase their financials. Venture financing from seed, series A, to later rounds like series E, debt, or even an IPO typically facilitates bigger sales deals/partnerships, more MRR, and more stable revenue.

Notably, all the major acquisitions we see are larger deals, like strategic acquisitions for hundreds of millions or PE acquisitions at a mature stage. This traditional process leaves a gap for many growing, healthy internet businesses that do not raise additional rounds of capital (post-seed, A) or later, or even companies that have never raised funds.

For example, let's take a SaaS company with a $1 million ARR and stable 5-8% growth. This growth rate is not a fit for most VC funds, or this company might not have a large enough market to create a multi-billion-dollar outcome, which most VCs desire in their portfolio structure.

This is where this evolving market comes into the picture. In recent years, we have seen the rise of marketplaces to facilitate smaller deals, strategic acquirers focusing on this deal size, micro PE funds like Tiny Capital, or even smaller funds like XOXO Capital, which mainly operate to acquire these kinds of companies. This provides founders with a health acquisition option unavailable until recent years.

While typical venture investors shy away from smaller $5M–$10M deals, this growing set of wealthy individuals and acquisition firms welcome these deals and have developed their playbook to manage these portfolio companies post-transaction.

Dealwise aims to make transactions in this space easier for both the sell-side and the buy-side with the help of their tech-first approach and fintech mindset.

Core Problem

Even though this is a flourishing market with considerable activity from both the buy-side and sell-side, it is in its early stages of evolution, bringing many opportunities and challenges for platforms like Delawise.

For founders, the core problem relies on accessing a decent set of buyers interested in buying their business. This is a highly fragmented and manual process involving M&A advisors and brokerage firms. This M&A process is non-transparent and has an extended timeline for founders since they have no expertise in M&A or complex processes.

For buyers, traditionally, buying a business starts with getting quality deals, which starts with cold outreach. Finding the right founder at the right time when they want to exit can be difficult; time spent on this unscalable sourcing process could have been used to grow their portfolio companies or to conduct due diligence on quality deals.

This space has many more challenges since the traditional M&A process involves expensive bakers and legal teams designed to do larger deals. They don't have the resources or incentives to do smaller deals since their operating model depends on the size of the transaction.

Currently story

Delawise has quickly become one of the largest repositories of startups that wish to exit, and the team has added multiple features to make conversion between buyers and potential sellers easier. Currently, the team focuses on increasing the top-of-the-funnel journey by introducing new ideas and valuable features.

The platform has already facilitated multiple acquisitions and is seeing healthy engagement from both sides. If you are someone planning to sell your business, go and list here 😄

As the wise folks of the internet say, "A startup exit isn't merely closing one door; it's about opening a window to new opportunities."

I'm already thrilled by the activities we're seeing in this space. I hope that as this market grows, buying or selling businesses will become more transparent, accessible, and doable for anyone. This also brings tremendous opportunities for every stakeholder in the ecosystem.

*Thanks to Jason for all the insights, and best wishes to the entire Dealwise team for all future growth.

Additional Info

Dealwise - URL

Jason - LinkedIn

Ayan - Linkedin